Here’s How To Get Your Digital TIN ID

For all taxpayers (and fresh grads applying for government IDs), you can now get your Digital TIN ID! No need to queue at your RDOs.

For all taxpayers (and fresh grads applying for government IDs), you can now get your Digital TIN ID! No need to queue at your RDOs.

The Bureau of Internal Revenue (BIR) recently launched the Digital TIN ID on Nov. 29, Thursday. This effort aims to provide Filipino taxpayers a more seamless and more secure way to access their Tax Identification Number (TIN) without going to their Revenue District Offices (RDO).

Table of Contents

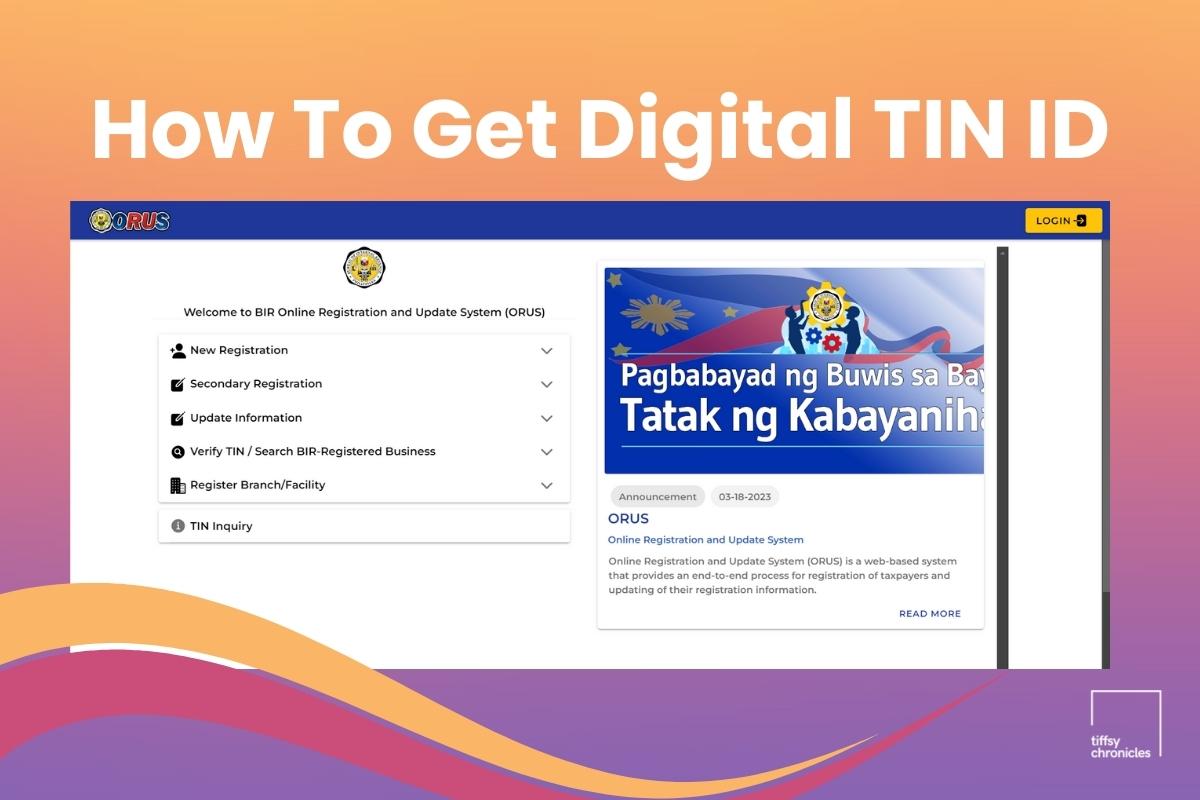

In the Memorandum Circular 120-123, the availability, use, and acceptance of the Digital TIN ID is mandated as an additional feature of the Online Registration and Update System (ORUS).

“The Digital TIN ID system shows our commitment to providing Excellent Taxpayer Service. With this new system, we can eliminate the practice of fixers and scammers selling TIN online while giving taxpayers a convenient alternative in getting a TIN, instead of lining up at our Revenue District Offices,” BIR Commissioner Romeo Lumagui Jr. said.

With this new option, you can use your Digital TIN ID as a valid government-issued ID just like the physical one for paying taxes, opening bank accounts, boarding flights, and applying for jobs among others.

NOTE: Both of the TIN IDs are permanent identification and will remain valid. Those who already have a Digital TIN ID won’t need to secure a physical TIN card.

The Digital TIN IDs do not require a signature, unlike physical laminated TIN IDs. You can verify the authenticity of the Digital TIN ID by scanning the QR code using the BIR ORUS website.

How to get your Digital TIN ID

Getting your Digital TIN ID is easier through ORUS. Individual taxpayers with an existing TIN can apply for it, even those without the physical card.

Remember, applying for a Digital TIN ID is FREE. All you have to do is to login through ORUS.

Step 1: Update your email address

If you haven’t updated your email address yet, you need to accomplish a registration form for the RDO where you are registered.

Fill up the Form S1905 – Registration Updated Sheet then email it to your RDO or through BIR’s eServices – Taxpayer Registration Related Application (TRAA) Portal.

Step 2: Online registration for Digital TIN ID

After completing Step 1, you can proceed with the online registration for your Digital TIN ID.

- Go to the ORUS website

- Register an account if you don’t have one or log in to you account

- Click on “Apply for Digital TIN ID”

- Upload a 1×1 clear, most recent photo with white background, no border, taken within 6 months

- Accomplish the required information

Digital TIN ID Sample

Check out this Digital TIN ID sample along with the TIN ID QR code and other details.

Reminders you need to know:

- You can only have one TIN (individual taxpayers) and it is illegal to get more than one TIN, according to the National Internal Revenue Code.

- Don’t upload unrelated images of animals, cartoons, and most especially other people’s pictures. Or else, you will be charged penalties by the BIR.

- You must face the camera directly, so no angled poses. Take a picture with both ears visible, with a neutral expression or smile not showing teeth, and your eyes should be visibly open. Think of it like you’re taking a passport photo.

- Head coverings or hats are acceptable, if they are due to religious beliefs, as long as they don’t cover your face.

- Photos that don’t follow the BIR’s guidelines would subject your Digital TIN ID invalid.

- If you wish to update your information like name, address, or change of RDO, you can regenerate your Digital TIN 30 days after generating the first one.

- The BIR also warned the public that those who provide false information shall be penalized with a fine of at least 10,000 PHP and imprisonment ranging from 1 to 10 years.